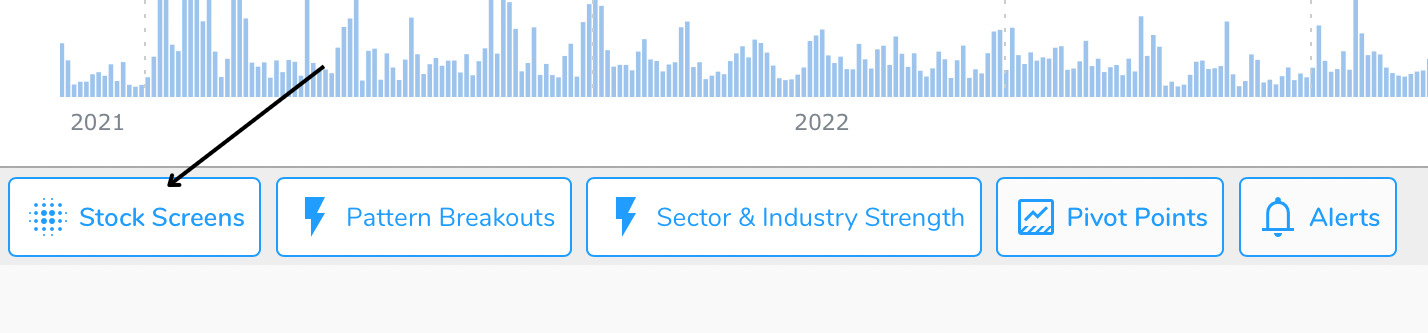

To scan for stocks that meet certain criteria, simple click the "Stock Screens" button. This button can be found by scrolling below the stock chart in the lower left hand corner:

From here, you can start a new screen, browse your saved screens, or load on of CML's pre-built screens in the left hand column.

Pattern Finder can scan over 150 metrics. Below is a handy reference for which tab each metric is located once you begin or edit a screen:

Financials and Growth Rates:

• Revenue in the Last Year (Revenue TTM)

• Revenue % Change - Last Reported Quarter

• Revenue Change % - Last Three Quarters

• Revenue Change % - Last Two Quarters

• 1 Year Annual Revenue Growth Rate

• 3 Year Annual Revenue Growth Rate

• Analyst Estimate Implied Revenue Growth % This Year

• Revenue Growth Implied One-Year Forward

• Revenue Growth Implied Two-Years Forward

• Revenue Growth Implied Three-Years Forward

• Revenue Average Change % - Last Two Quarters

• Revenue Average Change % - Last Three Quarters

• Revenue Average Change % - Last Four Quarters

• Revenue Average Change % - Last Five Quarters

• Revenue Average Change % - Last Six Quarters

• 5 Year Annual Revenue Growth Rate

• EPS - Last Four Quarters in Dollars

• EPS Over the Last Year in Dollars

• EPS - 1 Year Ago

• EPS - 2 Years Ago

• EPS - 3 Years Ago

• EPS % Change Average over the Last 2 Qtrs

• EPS % Change Average over the Last 3 Qtrs

• EPS % Change Average over the Last 4 Qtrs

• EPS % Change Average over the Last 5 Qtrs

• EPS % Change Average over the Last 6 Qtrs

• EPS % Change - 3 Years

• EPS % Change - 5 Years

• EPS % YoY Change - Most Recent Quarter

• EPS % YoY Change - One Quarter Ago

• EPS Change % Two Quarters Ago

• EPS % YoY Change - Three Quarters Ago

• EPS % YoY Change - Most Recent Year versus Prior Year

• EPS % YoY Change - Year Ago vs Two Years Ago

• EPS Estimates One Year Forward vs Current - Percent Change

• EPS Estimates for Next Quarter - Percent Change

• EPS Estimates for this Year - Percent Change

• EPS % Growth > EPS growth 3 Years Ago

• EPS % Change - 5 Years as Percentile

• EPS Results vs Estimates (Most Recent Quarter)

• EPS TTM > EPS Most Recent Fiscal Year

• EPS Acceleration - Last 3 Qtrs

• EPS Acceleration - Last 4 Qtrs

• EBITDA (TTM)

• EBITDA Margin

• Free Cash Flow - Most Recent Quarter

• Free Cash Flow Margin % (TTM)

• Free Cash Flow - TTM

• Cash from Operations (TTM)

• CF vs EPS % Difference - Last Reported Quarter

• CF vs EPS % Difference - Last Reported Year

• Gross Margin %

• Operating Margin >= Industry Median

• Operating Margin

• Net Income - Last Reported Quarter

• Net Income Margin Acceleration - Last 3 Quarters

• Net Income Margin Acceleration - Last 4 Quarters

• Net Income Margin - Average Last 2 Qtrs

• Net Income Margin - Average Last 3 Qtrs

• Net Income Margin - Average Last 4 Qtrs

• Net Income Margin - Average Last 5 Qtrs

• Net Income Margin - Average Last 6 Qtrs

• 3 Year Annual R&D Growth Rate

• 3 Year Annual Capital Spending Growth Rate

• Cash and Equivalents

• Current Ratio

• Current P/E > Average 5 Year P/E

• Debt to Equity

• Total Debt

• Dividend Yield

• 3 Year Annual Dividend Growth Rate

• Total Liabilities to Total Assets > Industry Median

• LT Debt to Working Capital

• Return on Assets (%)

• 5 Year Average Return On Assets

• Return On Average Total Equity

Stock Price, RS, Float, and Moving Averages:

• Current Stock Price

• Stock Price Change Today (%)

• Stock Price Change Today ($)

• Percent Price Change 1 Week

• Percent Price Change 10 Days

• Percent Price Change One Year

• Percent Price Change 4 Weeks

• Average Daily Percent Price Change 4 Weeks

• Percent Price Change 3 Months

• Percent Price Change 6 Months

• Stock Distance from Daily Low

• Percent Price Change MTD

• Percent Price Change YTD

• Stock Change vs S&P 500 for the Last 26 Weeks

• Latest Close As Percent Of 52 Week High

• Latest Close As Percent Of 52 Week Low

• Closing Range - Weekly High

• Closing Range - Weekly Low

• Low Price Last 6 Months

• Low Price YTD

• Current Stock Price vs 10 SMA

• Current Stock Price vs 21 SMA

• Current Stock Price vs 50 SMA

• Current Stock Price vs 150 SMA

• Current Stock Price vs 200 SMA

• RS New 52 Week High

• RS New 52 Week Low

• RS Line Within 5% of New High

• Stacked Moving Averages: 10 Day > 21 Day > 50 Day

• Stacked Moving Averages: 10 Day > 21 Day > 50 Day > 200 Day

• Stacked Moving Averages: 50 Day > 150 Day > 200 Day

• 10 Week Moving Average

• 150 Day Moving Average

• 30 Week Moving Average

• 50 Week Moving Average

• Float - Current

• Shares Outstanding

• RS Rating - 12 Month

• RS Rating - 3 Month

• RS Rating - 3 Month - Industry

• RS Rating - 12 Month - Industry

• RS 3 mo > RS 12 mo

• RS 3 mo Industry > RS 12 mo Industry

• Distance to nearest upside 18 mos

• Distance to nearest downside 18 mos

• Distance to nearest upside 3 Yr

• Distance to nearest downside 3 Yr

• Distance to resistance 18 Month

• Distance to support 18 Month

• Distance to resistance 3 Year

• Distance to support 3 Year

Stock Volume:

• Stock Volume (Intraday)

• Today's Volume > The Sum of the Last 5 Days Volume (1 or 0)

• Today's Volume vs 30-Day average of Volume

• Today's Volume > The Sum of the Last 10 Days Volume (1 or 0)

• Today's Volume > The Sum of the Last 20 Days Volume (1 or 0)

• Today's Volume > The Sum of the Last 50 Days Volume (1 or 0)

• Today's Volume vs 50-Day average of Volume

• 5 Day Total Stock Volume vs 50-Day average of Volume

• Up Volume to Down Volume Ratio 30-Days

• Up Volume to Down Volume Ratio 50-Days

• Up Volume to Down Volume Ratio 30-Days > 50-Days

• 5 Day Total Stock Volume vs 50-Day average of Volume Percentile

• Weekly Volume As Percent Of Shares Outstanding

• Total Volume 1 Week

• Total Volume Last 4 Weeks

• Total Volume Last 3 Months

• Total Volume Last 12 Months

• Average Daily Volume Last 10 Days

• Average Daily Volume Last Month

• Average Daily Volume Last 4 Week

• Stock Volume (50 Day Average)

• Average Daily Volume Last 3 Months

• Average Daily Volume YTD

• Volume Yesterday

• Average Volume Last 12 Months

Valuation and Valuation Ratios:

• Market Cap (Millions)

• Enterprise Value (Millions)

• Price to Sales

• Current Year Forward Price to Sales

• Next Year Forward Price to Sales

• Current Price to Earnings

• Current Year Forward Price to Earnings

• Current Price to Earnings Compared to the S&P 500

• Price to Earnings as a Percentile to Overall Market

• Price to Earnings as a Percentile to Industry

• Price to Earnings Growth Ratio

• Price To Book

• Price To Free Cash Flow

• EV to FCF

Proprietary Ratings:

• Buying Selling Strength Rating

• Overall Rating

• EPS Rating

Company:

• Ticker

• Sector

• Industry

• Next Earnings Due Date

• Verified Earnings

• Earnings Most Recent Report Date

Institutional Holders:

• Institutional Ownership > Industry Median

• Institutional Ownership %

• Institutional Ownership Change %

• Number Of Institutional Owners